Two Kinds of Investment in Agricultural Communities

The financial investment in Ag Tech development and the societal investment in adopting a digital mindset

Agriculture is one of the last traditional industries to be brought into the digital age. Ag Tech, or agricultural technology, is permeating a field that is ripe for sowing seeds of change to marry the clear need for innovation with emerging opportunities for progress. While some would say the first wave of technological innovation reformed information industries like journalism, fact-finding, and communications, we are now seeing a second wave of technology reshaping those traditional industries, with one of the most basic ones being agriculture.

Ag Tech is an impactful and fruitful endeavor because it is timed perfectly with the alignment of certain trends and emerging demands for agriculture, and potential opportunities for the viable application of these resources. Some examples of technologies that are making farms smarter, more productive, and wildly more efficient are driverless tractors tilling acres of crops, climate-controlled warehouses nurturing produce, and genetically altered seeds requiring less water. I am even personally working in a lab on campus to develop smarter technologies to detect and diagnose diseases in grapes for the next generation of vineyards: smart vineyards.

The need for technology and innovation in agriculture can never be understated. In fact, somewhat uniquely so, agriculture is an industry that truly everyone needs. Everyone eats food, after all. So technology that improves productivity for even a small number of farmers, ultimately scales up to help everyone. Indeed, that is why our focus on small farmers is not a trivial matter. We understand and fight for the small farmers who serve as the backbone of our food production system, a system we all need to live.

The time for this innovation is also now. By 2050, the global demand for food production is expected to nearly double with the world having 3 billion more mouths to feed than it does today. Additionally, more of those people will live in cities — 66% in 2050, compared to the 54% in 2014. This means even more of the population will be even farther from traditional food sources like rural farms. Climate change is also putting more of a demand on how sustainable food is grown, while simultaneously there are even fewer agricultural workers. In developed countries, there has been a 31.8% drop in agricultural workers since 1950; and in developing countries, there has been an almost equivalent drop of 32.8%.

While we intimately recognize that internet connection is not yet universally accessible, as it should and hopefully will be in the growing decades, there are still incredible opportunities in our increasingly interconnected world for technology to engender a more productive, efficient, sustainable, and resilient food production system.

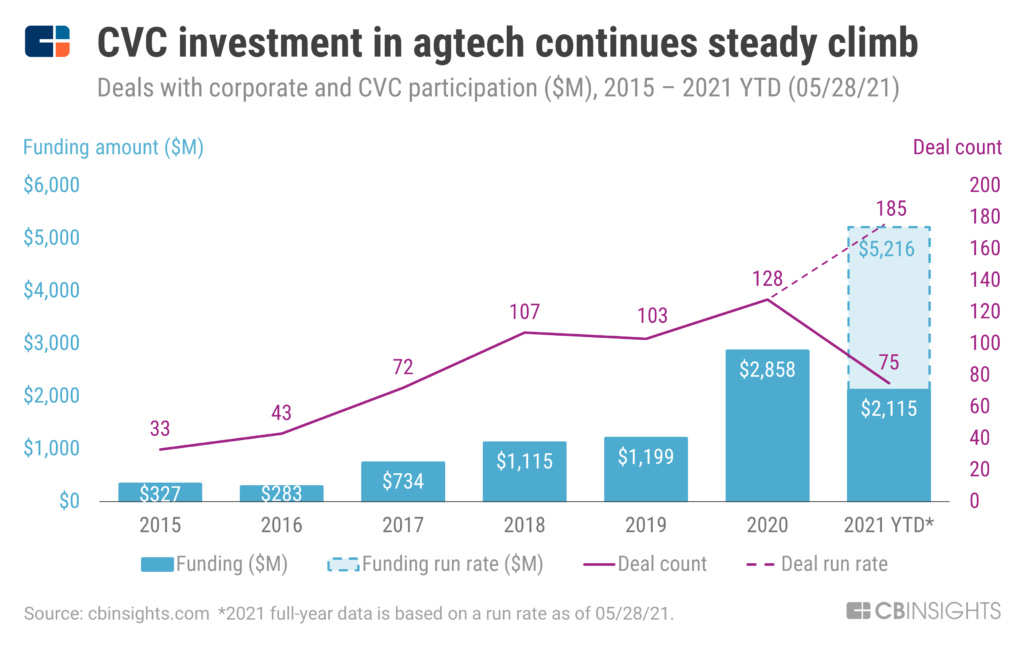

And we are not the only ones recognizing this. VC funding in Ag Tech — although it may appear to be seedlings in comparison to overall VC funding — has been growing steadily in recent years. According to CB Insights, VC firms poured $735 million into 147 deals in 2017, which is a big jump from $57 million for 71 deals in 2013.

In addition to VC firms increasing their investing in Ag Tech startups, bigger farming conglomerates are also paying more attention. For instance, the farming equipment giant Deere & Co. has an intelligent solutions group focused on precision agriculture that now employs more than 300 software developers, engineers, and testers. In 2017, it bought precision agriculture startup Blue River Technology for $305 million. Monsanto, a major global producer of seeds and agricultural products, executed one of the largest acquisitions in the Ag Tech space when it purchased big data company Climate Corp for $1.1 billion in 2013.

For startups in the space, there are a few major opportunities emerging for Ag Tech:

Analytics ($825 million from investors): monitoring technologies and data analytics that can make sense of satellite monitoring and or weather simulations; a major area of growth within this is precision agriculture, the niche field wherein Agcess lives — it involves collecting and analyzing data at the individual plant level. In fact, a survey of American farmers who used precision agriculture technology reported average cost reductions of 15% and a 13% increase in yields.

Automation technologies ($400 million): driverless tractors and automated irrigation systems that collect information about soil and water levels improve efficiency, labor costs, and productivity.

Product innovations ($4.36 billion): gene editing or cellular agriculture that are designing entirely new kinds of foods; Impossible Foods which is bringing lab-grown meat to popular consumption.

Digital marketplaces ($682 million): software to allow farmers to lease equipment, pool together for better insurance, or connect to local farmers; Full Harvest helps farmers sell imperfect produce that would be rejected from supermarkets.

Operations software ($129 million): startups helping farmers to track resources or productivity to save money and make more efficient, environmentally conscious decisions.

Resources ($755 million): new systems that operate more efficiently, preserve the environment better, and save the farmer more operating costs; irrigation systems that deploy highly targeted water and fertilizer, and vertical and urban farms use less land and reduce pesticides.

As we’ve previously discussed, innovation is only as useful as it is adopted. And, for a sector that often lags behind in technological development, the challenges in Ag Tech go beyond just investment dollars and software creation. Smarter farms also require smarter farmers and more technologically advanced workers who can operate these new resources, alongside the basic technology infrastructure (like broadband) that can support innovative farming techniques. For true progress to take root in agricultural communities, we have to change the mindset as much as the investment.